w/b Monday, 26th June

Datasets reproduced in partnership with

Gas

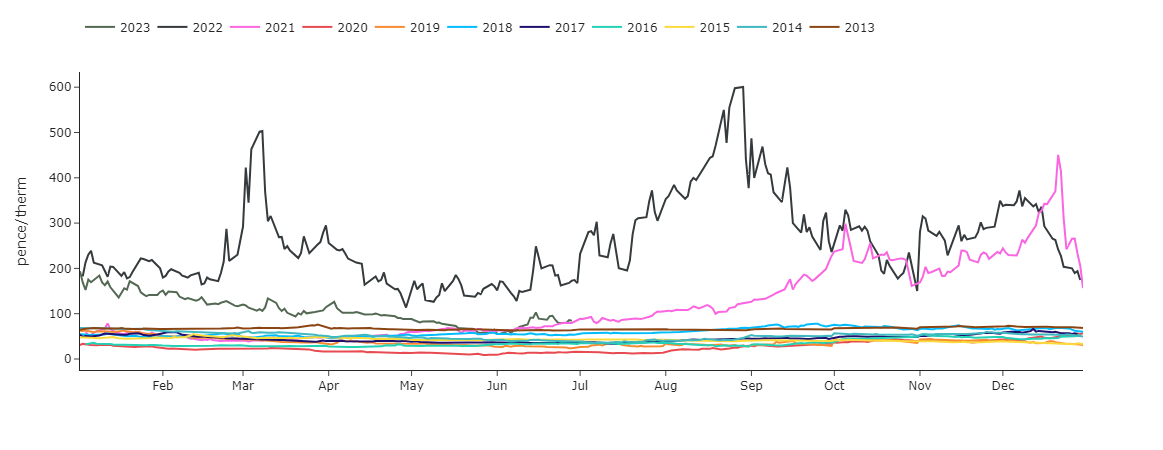

UK gas markets have traded sideways this week. Whilst prices remain elevated when measured against pre-pandemic levels, it’s fair to say that prevailing volatility pales in comparison to the rollercoaster swings of 2021 and 2022 (see chart detailing month-ahead prices, 2013 to present). Despite recent bullish reactions to extended Norwegian maintenance and Russian instability, delivery prices all the way down the curve are broadly circa. 25% lower now than they were at the turn of the year. But whilst received wisdom would expect for financial markets to fall faster than they rise, this certainly hasn’t been the case for wholesale UK gas in 2023! The slide has been shallow and tentative, with 100p/therm proving to be a rock solid level of support (so far). 62 days of summer conditioning remain until we reach the “shoulder” month (September being the month prior to the onset of Winter ’23). Clients with open/unlocked Winter ’23 volumes continue to scale-in/partially hedge, in the hope that Summer ’23 still has some more downside to offer before the rigours of winter conditioning take hold. Right now, weak numbers coming out of China are keeping a lid on the upside, whilst geo-political uncertainty (and the protracted loss of Russian gas exports into Western Europe) bars the way to further downside. Fundamentally, EU storage is at 77% versus a 5-year average of 61% – so we look on track to hit storage targets of 90% before the onset of Winter ’23. Unweighted (Heren) monthly Day-Ahead averages for June achieved 80p/therm (or 2.7p/kwh). Given the time of year, and prevailing bearish fundamentals, the outlook remains neutral to bearish – though further rejections of support (at circa. 100p/therm) will likely indicate that we’ve already seen the bottom of the Summer ’23 market.

Electricity

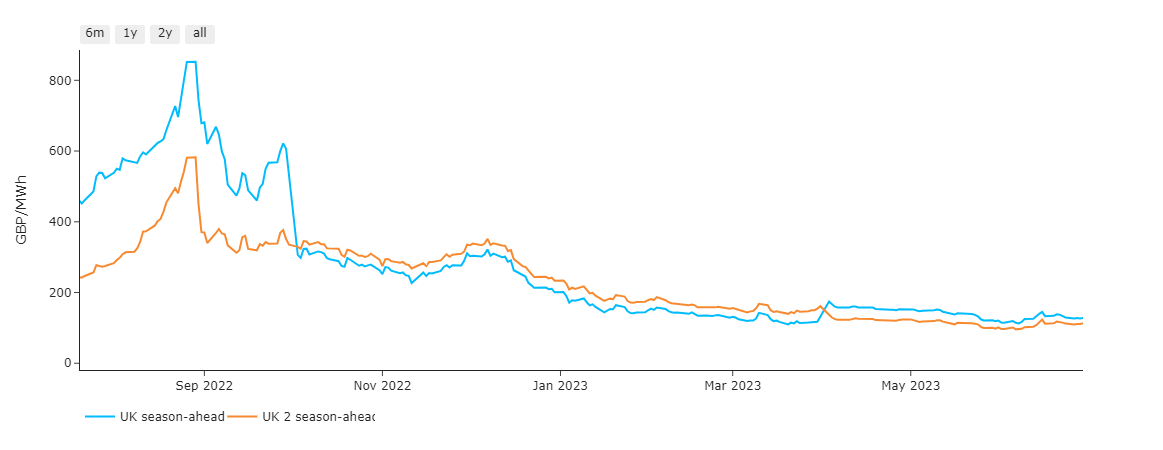

As a further indicator that UK energy market volatility has dropped off significantly, the interplay between Summer/Winter price levels returned to normal as far back as the onset of Winter ’22 (see chart showing season-ahead & 2-seasons-ahead). It’s easy to forget just how unliveable the markets became at the highs of August ’22. Whilst energy prices continue to pressure profit margins, it’s always worthwhile for buyers to reflect that Winter ’23 delivery prices now are at a 76% discount versus 26th August ’22. Today’s generation mix is bearish with 45% renewables; 30% low carbon; 17% gas for power burn. Unweighted (N2EX) monthly Day-Ahead averages for June achieved £84.23/mwh (or 8.423p/kwh). Outlook is neutral to bearish, but market particpants seem all too ready to push the market up at the smallest hint of trouble.